HUD Announces FHA Changes Starting October 4th, 2010

How are HUD Guidelines Changing?

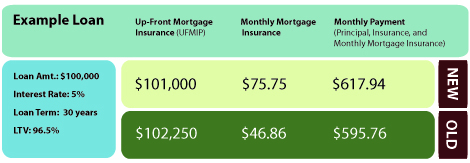

HUD has announced the following guideline changes for loan terms greater than 15 years:

- Lower the Up-Front Mortgage Insurance Premium (MIP) from 2.25% to 1%,

- Increase the annual (monthly) MIP From .50–.55% to .85–.90%, depending on Loan-to-Value (LTV).

When Do Policy Changes Take Effect?

This policy change is scheduled to begin for case numbers issued on October 4, 2010.

How Will These Changes Effect Borrowers?

A borrower will need an estimated $75-80 more in monthly income, or $900 more per year, to qualify per $100,000 in loan amount.

Why is HUD Changing FHA Mortgage Insurance Premiums?

High demand for FHA loans put pressure on the capital reserve of the FHA insurance fund. Guideline changes will increase the mortgage insurance paid by borrowers, thus increasing the FHA insurance fund reserves.

Save Even More on Your Austin Mortgage Rate

Exclusive Float Down Program available for most Conventional and Government loans. If mortgage rates go down after you lock in your interest rate with The Leaman Team, you have an option to lower your interest rate ONE time, guaranteeing you a great mortgage rate.

Leaman Team wants to make sure your questions are answered. Please call Leaman Team today to discuss your home financing: (512) 710-1400 or email LeamanTeam@LoanPeople.com.