A combination of factors helped Austin mortgage rates improve yet again during the short Thanksgiving week. Strong demand for the Treasury auctions, low inflation, and a fragile economy were all positive for mortgage markets. As a result, mortgage rates dropped to the lowest levels since January.

The consensus economic outlook is for a gradual recovery with low inflation, and the economic data released during the week was consistent with this view. Economic growth during the third quarter of the year was revised lower, but both the Fed and private economists raised their forecasts for future growth. This week’s economic reports indicated that some sectors of the economy are improving, such as the housing market (see below), while others reflected weakness. Wednesday’s data on Core PCE prices continued to show little inflationary pressure, which allows the Fed to keep rates low to assist the economic recovery.

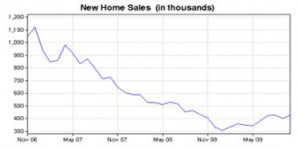

This week’s home sales data far exceeded expectations across the board. October Existing Home Sales jumped 10% from September. Inventories of unsold existing homes dropped to a 7.0-month supply, the lowest level since February 2007. October New Home Sales rose 6%, and inventories of new homes declined to the lowest level in decades. Extremely low mortgage rates, high affordability levels, and the first-time homebuyer tax credit boosted sales in October.

Week Ahead

Next week, the important Employment report will come out on Friday. As usual, this data on the number of jobs, the Unemployment Rate, and wage inflation will be the most highly anticipated economic data of the month. Before the employment data, the Chicago PMI index will be released on Monday. The ISM Manufacturing index and Pending Home Sales will come out on Tuesday. ISM Services will be released on Thursday. Productivity, Construction Spending, and Factory Orders will round out the busy schedule. The Treasury will announce the size of upcoming auctions on Thursday as well.