While daily volatility was high this week, Austin mortgage rates ended just slightly lower than last week. The primary factors influencing Austin mortgage rates were offsetting. The economic growth data released this week was stronger than expected, but inflation remained low. While the first two Treasury auctions produced impressive results, the final one was relatively weak.

Demand was extremely strong for this week’s 2-yr and 5-yr Treasury auctions, but it slacked off considerably for the 7-yr securities. When demand is low, higher yields are required to attract investors. In addition, the Treasury is interested in shifting its issuance toward a greater percentage of longer-term securities relative to shorter-term securities to lock in currently low rates. For mortgage markets, though, a move in this direction would add to the supply of competing investments. The Fed is already in the process of winding down its purchases of mortgage-backed securities, removing demand from the market. Higher supply of long-term investments and lower demand would pressure Austin mortgage rates higher.

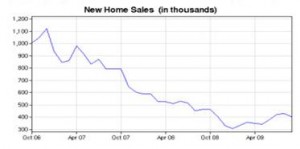

Government influence on mortgage markets has been substantial. It has pushed Austin mortgage rates to historically low levels and has made credit available where it might not be otherwise. Two important programs, the first-time homebuyer tax credit and the extended conforming loan limits, were set to expire soon. Fortunately, both programs received strong support from lawmakers this week and are likely to be extended.

| Week Ahead

The biggest economic event next week will be the Fed meeting on Wednesday. While no change in rates is expected, the Fed may indicate future changes in monetary policy. The important Employment report will come out on Friday. As usual, this data on the number of jobs, the Unemployment Rate, and wage inflation will be the most highly anticipated economic data of the month. Early estimates are for a loss of about 165K jobs in October. In addition, the ISM Manufacturing index and Pending Home Sales will come out on Monday. ISM Services will be released on Wednesday. Productivity, Construction Spending, and Factory Orders will round out the busy schedule. The Treasury will announce the size of upcoming auctions on Wednesday as well. |

| To learn more about news impacting interest rates and mortgage markets, go to www.mbsquoteline.com |