During a very light week for economic news, the economic data and Treasury auctions contained few surprises and produced little reaction in mortgage markets. Mortgage rates ended the week nearly unchanged.

In early 2009, the Fed embarked on a $1.25 trillion mortgage-backed securities (MBS) purchase program to help keep mortgage rates low and stimulate the economy. The amount purchased varied from week to week, reaching a peak of $33.2 billion in the week of March 25, 2009. The Fed has been gradually reducing the size of its purchases at a pace consistent with a March 31 conclusion of the program, and the most recent weekly purchases have been down to around $10 billion.

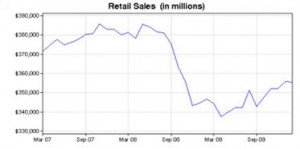

As the date nears, the big question is what will happen when the MBS purchase program ends. This program is unprecedented, making the outcome difficult to predict, and forecasts vary widely. Estimates for the impact on mortgage rates from the conclusion of the program vary from an increase of one percent to no change. Those who predict higher mortgage rates point to a basic change in the fundamental supply and demand. The added demand from the Fed was widely credited with moving rates lower, and a decrease in demand would typically push rates higher. However, other economists argue that investors respond only to unexpected news. In this view, since the Fed has telegraphed the end of the program for months, there should be little reaction around March 31. The Fed itself has indicated that they expect a modest increase in Austin mortgage rates due to the end of the program.

Week Ahead

The big story next week will be Tuesday’s Fed meeting. No change in the fed funds rate is expected, but any surprises in the Fed’s statement could produce a large reaction. The most significant economic data next week will be the monthly inflation reports. The Producer Price Index (PPI) focuses on the increase in prices of “intermediate” goods used by companies to produce finished products and will come out on Wednesday. The Consumer Price Index (CPI), the most closely watched monthly inflation report, will come out on Thursday. CPI looks at the price change for those finished goods which are sold to consumers. In addition, Industrial Production, an important indicator of economic activity, will be released on Monday. Housing Starts are scheduled for Tuesday. Import Prices, Leading Indicators, and Philly Fed will round out a busy week.